Sustainable Growth Through Partnerships

By Ana Sofia Almagro, Hendrik Jandel, Sandra Steving Villegas

With special thanks to James Donovan

Sustainability has taken a back seat during the COVID crisis, but the urgency to act has not diminished. Sustainability is the next frontier for corporates, there is capital (Blackrock’s Larry Finch’s call to action), political backing, media focus and increased consumer demand to back it.

Prior to the crisis, over 90% of corporate leaders believed in a more sustainable core business (HBR) but very few, only 4%, have been able to make it a reality (Bain). We believe that responding to COVID and transforming your business into a sustainable business are not incompatible.

“When a hurricane sweeps through a shanty town, you do not want to re-build a shanty town — you want to rebuild something stronger” — Bernard Looney, BP CEO

In this post we explore one lever all corporates have in their toolbox to begin to execute on their post-COVID and sustainability strategic goals — partnering with start-ups. Partnering with start-ups enables corporates to test, scale, and redefine their core business more cheaply, effectively and efficiently than through build or buy alternatives.

Although today we dive into the how of sustainability we often get asked why a corporate should care about sustainability initiatives, in short:

- They drive real commercial outcomes — often in the form of savings

- They appeal to evolving consumer demands many of whom are willing to pay more

- They can solve existing corporate pain points (see below)

Why partner with startups?

Cheaply and quickly experiment with cutting edge tech

Start-ups are driving the change in the industry with more than 50% of all sustainability / climate change related news are related to start-ups (Dealroom). There is capital to back the kind of technology experimentation many corporates shy away from, ~12% ($4Bn) of total 2019 European tech investments went to sustainability & purpose-driven start-ups, more than double any previous year (Atomico). By working with start-ups corporates can cheaply and quickly experiment with new, sustainable business models and access the newest innovation. According to IESE Business School, partnering costs on average 18% of the total cost of building a new capability in house with an average cost of a partnership at €47K (IESE).

FI CASE STUDY: We worked with an international CPG to understand how to meet their 2030 sustainability goals by testing and scaling new technologies through partnerships. We developed a playbook and deployment plan outlining the operating model of a formal partnership program, its operating and governance structures, and the KPIs to evaluate and report its impact — all tailored to their sustainability objectives and technologies.

Solve pain points sustainably [Non-Exhaustive]

Although committing to a new operating model, structure, or entire processes is often daunting, partnerships are one way corporates can dip a toe in sustainability and build a case for larger initiatives by tackling immediate pain points. The good news is, there are often high potential start-up partners across industries and across value chains. Some of the biggest areas of start-up activity include:

Packaging & Materials:

As the circular economy figures out where to start the chicken and egg problem always leads to packaging and materials. Although it has taken time for technology to catch up to sustainability’s need start-ups and corporates alike have experimented with alternative packing and materials. The sustainable packaging market is expecting to reach over $230Bn in 2024 at a CAGR of 5.7% over the past 5 years (source), globally.

CASE STUDY: H&M designs a fully sustainable collection. H&M has been well known for experimenting with a range of approaches to sustainability including a bag that turns into a clothes hanger. But their boldest innovation has been to release an entire new collection, Conscious Exclusive @, brought to market through a multitude of partnerships including: BLOOM Foam, Orange Fiber, and Pinatex following a series of other fashion houses experimenting with sustainable materials. See our recent chat with Niklas Zennström, serial entrepreneur, board member of H&M and sustainability advocate.

Supply Chain Transparency & Tracking:

Digital supply chains, smart sourcing, tracking, and control towers should all be familiar by now, getting a supply chain right has been the bane of the existence of many a non-tech first company. COVID has provided a spotlight for companies who invested in agile, transparent, and flexible supply chains more than ever before. As many companies scramble to transform their analog supply chains into digital from one day to another we invite you to consider how sustainability can be part of that agenda. We are talking about transparency, demand planning, and supply chain visibility — this almost always goes hand in hand with a more sustainable supply chain.

CASE STUDY: Unilever works with Provenance on supply chain transparency. The partnership “combined blockchain technology, supply chain transparency and financial savings aiming to improve the livelihoods of smallholders worldwide through sustainable agricultural outcomes”. They developed the ‘Trado Model’ — a data-sharing process connecting first-mile producers, last-mile consumers and the supply-chain players in between, this has enabled large savings for both factories and farmers. Alongside this Unilever is running a trial in the accounts payable process of their Americas supply chain encouraged by the ability to rapidly test this new technology with partners.

Waste & Recycling:

Many companies have tried to tackle the waste and recycling problems generated especially by FMCG, some of the most notable include Coca Cola’s World Without Waste programs’ lofty objectives or Sky’s Ocean Rescue initiatives (one of the top investors in sustainable packaging). Although waste and recycling don’t come with obvious commercial outcomes it turns out there are huge potential savings — especially for grocers, who are estimated to waste £5Bn a year in food waste. Halma, a FTSE100 industrial company worked with us to conceive a new venture called One Third. OneThird specialises in helping retailers to reduce food waste of fresh produce by predicting shelf-life. Other case studies include:

FI CASE STUDY: Unilever has partnered with Too Good to Go and Karma, an anti-food waste app facilitated by Unilever Foundry and Founders Intelligence. The collaboration means “food service companies can easily offer leftover portions to the users in a set timeframe and on flexible terms,” it helps reduce food waste and potentially increase the restaurants customer base. The partnership is a revenue share agreement between the start-ups and Unilever in exchange for Unilever scaling sustainability solutions to their chef network. The partnership has now scaled across the UK, Germany and the Netherlands.

CASE STUDY: Kroger offers products with longer shelf life using Apeel Sciences, but experimenting with partnerships only scratches the surface of Kroger’s waste and recycling initiatives who has also launched initiatives to convert food waste into renewable energy. “The 150 tons of food waste the company produces each day at its Ralphs/Food 4 Less Compton distribution centre — which used to be seen as a major cost in terms of lost revenue, disposal fees and emissions — now provides inexpensive, clean energy. That energy in turn powers a 49-acre campus that houses Kroger’s offices as well as the distribution centre… To date the initiative has yielded an 18 percent on Kroger’s investment.”

How to partner with start-ups?

The opportunity areas for sustainability are ample but the value and impact lies in execution. What could a start-up partnerships for sustainability look like?

Types of partnerships

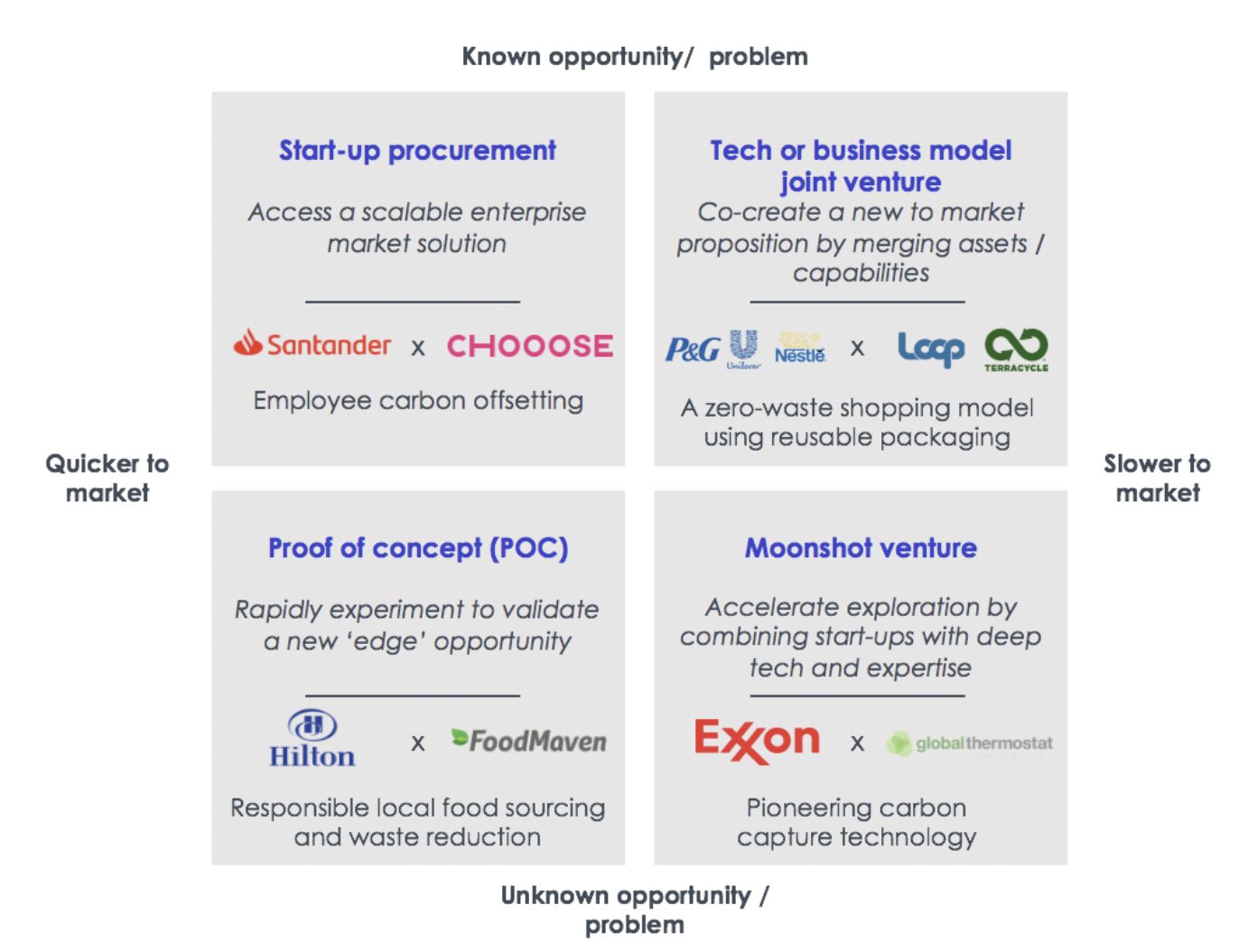

We like to think of partnerships across “opportunity identification” and “time to market” matrix.

Start-up procurement:

The most “traditional” kind of partnership leverages a companies’ existing processes and tools for establishing vendor relationships with a start-up. This works best when a start-up is a complementary bolt-on type of solution that is highly compatible with existing processes and tools.

Why does this help with sustainability? It allows you to incorporate a “fully baked” market solution into your BAU with minimal disruption. But note this will likely not bring about a sustainability transformation.

Proof of concept:

A proof of concept is usually a step in a longer partnership journey where a corporate tests and often co-builds a new solution with a partner that validates a potential market opportunity. This allows a corporate to test a new technology cautiously and cheaply join forces with a potential partner to evaluate longer term commitments and / or market appetite.

Why does this help sustainability? Many sustainability solutions are entirely new technologies and entirely new to market, running a POC enables companies to test how a solution adapts to their products / markets and the potential scalability before committing to radical transformation. (It also helps you build a business case internally with real data and results).

Tech or business model joint venture:

You are probably already familiar with the concept of a joint venture. A classic partnership type it often requires serious commitment from both partners (and sometimes more, like outside investors). It works best for players with compatible assets who are confident in a market opportunity and willing to build something entirely new an external, together.

Why does this help sustainability? Many of the problems in sustainability are collective action problems (e.g. recycling, supply chain tracking). This means they require multiple players to make a dent in a solution AND more often than not an entirely reimagined solution altogether. A joint venture allows a company (or set of companies) to go to market with something entirely new and allow it to become a part of the competition.

Moonshot venture:

Moonshot, a coin most often used by Google X, an approach that combines bleeding edge technology, social good, and unparalleled ambition. Few corporates embark on this kind of capital intensive adventure. This is the kind of adventure that has the potential to truly revolutionise a market, but it does take time and the right partners. Examples include Tesla, revolutionising electrical vehicles, and consortia the likes of Carbios which includes L’Oreal, Nestle, and Pepsi among others — committing to bringing new, bio-industrial solutions to reinvent the lifecycle of plastic and textile polymers, one of the first to create 100% entirely recycled material plastics.

Why does this help sustainability? Although arguably the most challenging type of partnership, often involving multiple parties, this partnership is ideal for truly scaling cutting edge technologies. It enables players to pool their collective market share to set a new standard for the industry. In sustainability, cutting edge technologies often require efficiencies of scale to make the margins work and Moonshot ventures enable a company to place itself at the centre of the revolution.

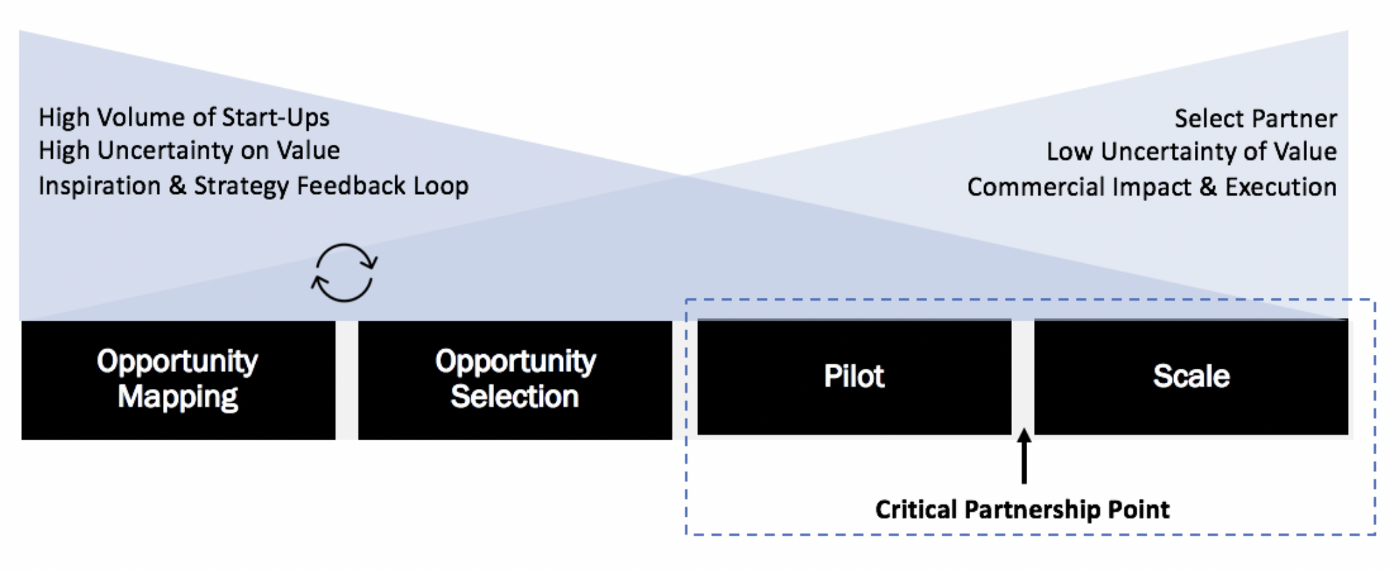

Considerations for a systematic approach

The reality of partnerships is that many fail to deliver tangible results. This is usually due to: lack of enabling structures (streamlined procurement for start-up partnerships), buy in from leadership to business unit commitment to experimentation, and lack of ring-fenced budget to bring partnerships from ‘test’ to scale. However, it is possible to create a systematic approach to running sustainability-oriented partnerships and sustainable growth more broadly with the right methodologies, processes, and incentive structures (See our post on making start-up corporate partnerships work).

Having developed an understanding of bringing partnerships to market for close to a decade, we have developed a set of Entrepreneurial Processes and Methodologies that can help you navigate the start-up landscape and come closer to sustainability outcomes as you reimagine a post-COVID reality.

If you want to know more about the structure of a Sustainable Growth Function, stay tuned for our thoughts on Sustainable Entrepreneurial Growth.

Founders Intelligence is a team of entrepreneurs and strategy consultants. We help corporates understand how digitally enabled business models are affecting their industries and what to do about it.

Our team has extensive cross-category experience, working with Fannie Mae, Visa Europe, Shell, Unilever, Diageo and numerous other FTSE 100 / Fortune 500 companies.