Reliability — Overlooked Crucial Factor in Startup Valuations

We live in an era of booming startup investments. Many companies achieve over billion-dollar valuations in private markets and gain the honorary Unicorn title coined by Aileen Lee in her 2013 article.

The media and business worlds are full of statements about Unicorns being worth this or that amounts, usually based on the latest shares trade transactions of those companies — mostly funding rounds, sometimes secondary trades.

But, there is one crucial factor missed from almost all commentaries about startup valuations: it is reliability — reliability of the implied valuations of funding rounds to serve as a proxy for how much the company is worth.

Here is the logic:

The fact that the company raised funds at a certain valuation, does not necessarily mean that the company is worth that valuation.

So, the key question is:

How reliable is the valuation implied by particular shares trade transaction in representing the company’s worth?

Although rarely asked, this question is so important that by ignoring it you can theoretically create a Unicorn business in 1 minute with just one dollar and a mug. Details about how to do at the end of this post.

How do we assess the reliability of valuations?

For any shares trade transaction to be a reliable representative of the company’s value, it must pass the following 4-measure check:

1. The shares traded should be common shares of the company

2. The shares should be traded many times to validate the price

3. The shares should be traded in high volumes

4. The shares should be traded by many different types of investors

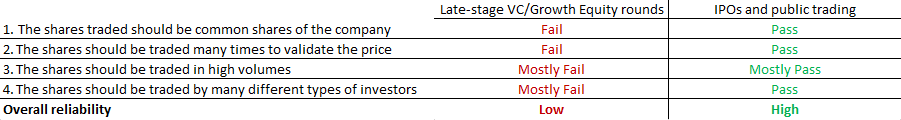

To summarise:

The most reliable valuation is the one defined by the transaction in which it is validated by the opinion of many investors who put significant money where their mouth is — the wisdom of crowds who have skin in the game.

To see how it works, let’s apply this checklist to the average shares trade transactions in Early-stage VC/Seed/Angel rounds, Late-stage VC/Growth Equity rounds, Acquisitions and IPOs/public trading.

Early-Stage VC/Seed/Angel Rounds

1. The shares traded should be common shares of the company — Mostly pass

Although officially the shares traded in early-stage rounds can be preferred stock, in reality, they are pretty much common stock as they usually contain insignificant preferred provisions.

2. The shares should be traded many times to validate the price — Fail

A single transaction is happening.

3. The shares should be traded in high volumes — Fail

Mostly, only 5–20% of the company is exchanging hands with small overall volume.

4. The shares should be traded by many different types of investors — Fail

1–3 Angel/Seed/VC investors are participating.

- Overall reliability of valuation — Low

Don’t be mistaken, the low reliability is not because the companies are in an early and uncertain phase of their life-cycle. Even if they were in a mature and cash generative stage, failing three criteria in a 4-measure check would still give low credibility score.

Late-Stage VC/Growth Equity Rounds

1. The shares traded should be common shares of the company — Fail

In most cases, the preferred stock is traded with anti-dilution, liquidation preference and other rights.

2. The shares should be traded many times to validate the price — Fail

The single transaction is happening.

3. The shares should be traded in high volumes — Mostly Fail

Here the failure is to a lesser degree than in early-stage rounds. Usually, 5–30% of the company is exchanging hands and sometimes volumes can be quite respectable up to several hundred million dollars.

4. The shares should be traded by many different types of investors — Mostly Fail

Again, failure is to a lesser degree than in early-stage rounds. Usually, up to 6–7 investors participate in late-stages and they are more diverse.

- Overall reliability of valuation level — Low

Late-stage VC/Growth Equity rounds vary in their nature dramatically and some are more reliable than others, but on average the above checklist results will hold true.

Notably, these rounds are the ones which in most cases give companies their industry superstar Unicorn status. But as we see, their credibility for representing the company’s worth is still low.

Acquisitions

1. The shares traded should be common shares of the company — Pass

Common stock is traded and frequently even preferred shares get converted to common ones.

2. The shares should be traded many times to validate the price — Fail

The single transaction is happening.

3. The shares should be traded in high volumes — Pass

50–100% of the company is exchanging hands.

4. The shares should be traded by many different types of investors — Fail

Acquisition is a statement of opinion about the valuation by a single (maybe sometimes two) acquirer.

- Overall reliability of valuation level — Medium

IPOs and Public Trading

1. The shares traded should be common shares of the company — Pass

The shares listed on public exchanges are common shares.

2. The shares should be traded many times to validate the price — Pass

The price of a publicly traded company gets validated many times per day.

3. The shares should be traded in high volumes — Mostly Pass

Trading volumes and liquidity vary by company and by geography, but in developed countries trading volume for public stocks can be up to 100% of the market capitalisation per year.

4. The shares should be traded by many different types of investors — Pass

Public markets include various diverse participants, large institutional investors and even retail traders.

- Overall reliability of valuation level — High

As we see by comparing the four most common shares trade events, public pricing usually is the only highly credible representative of the company’s worth.

Now many can rightly point to the occasions when the public market was delusional and blind to some mis-pricings discovered by selected few professionals. But although far from ideal, as stated above in vast majority of cases wisdom of crowds who have skin in the game will give the most credible opinion, and public markets are the best thing available for this.

Implications for Valuations

Assessing the reliability factor in valuations is an absolute must, and unfortunately, is frequently ignored by the startup community, even by professional investors. As a result, we have seen quite a lot of mis-pricing happening in the private investments markets.

For example, look at the comparison in the following table:

Most startups go to IPO right after late-stage VC/Growth Equity rounds and expect the valuation to be benchmarked to those rounds. There are many factors playing a role in underperformance of technology IPOs recently with some suggested solutions. But, in my opinion, the biggest driving factor was that the IPO price was pushed by the companies to be built on the valuation of their previous VC/Growth Equity funding rounds, and it faced a reality check when it transitioned to the more credible world of public trading. This is what we saw during the first 6 months of IPO of Snapchat, Lyft, Uber, Slack, and many more.

Overlooking reliability is a common mistake in private investment markets. We frequently see startups raising funds at valuations benchmarked to other startups’ late-stage funding rounds, building their unreliable valuation levels based on other unreliable ones. It comes as no surprise that it all comes down to earth after the “judgement day” of the IPO during the initial months of public trading.

As Promised: How to Create a Unicorn in 1 Minute with One Dollar and a Mug

Take a mug and ask your friend to buy a 0.0000001% stake in it for 1 dollar (a good friend will do this for you). Here you go, you have a private asset with an implied valuation of 1 billion dollars. To make it all official you can even go and register it as a business legal entity, but by running a 4-measure credibility check I suspect you will conclude that it might not be worth the effort.

This is obviously an extreme example, but it shows theoretically how much headroom you have for creating a ridiculous valuation level if you ignore the reliability factor.

Conclusion

The 4-measure reliability check must be conducted every time we are analysing the valuation of private companies. If you are investing, joining one, or just conducting the market study, know that valuation levels can vary in their credibility. Do not take them at face value and pay attention to the steps in the 4-measure check before making any decision. As a result, we will have a healthier startup and investment community for founders, employees, investors, and the overall economy.