Banks Are Not Fit To Be FinTech Acquirers

With the rise of technologically driven ventures in financial services over the past decade, banks have been anticipated more and more to start resembling their big tech peers and go on a shopping spree for FinTech companies.

In the current wave of the post-2008 crisis period, the Banking-FinTech relationship started with a hostile call to disruption and shouts of Revolution. But realising things were not that simple, by 2014–2015 “R” was dropped and softened to Evolution, with partnership conversations replacing disruption talk. Afterwards, most partnerships proved to be frustrating to execute for both parties and turned into a client-vendor form of collaboration, while minority venture investments became most common events on that dating scene. So the ecosystem participants are eagerly awaiting the start of Banking-FinTech M&A boom like a culmination of their favourite romantic soap opera — when are they finally going to confess love to each other and get married already?!

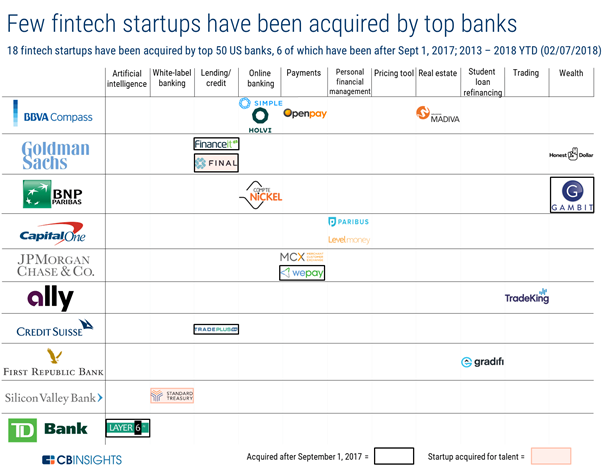

Yet it is almost universally accepted that in contrast to the technology world, banks have been passive in proposing to FinTech startups so far. Two years ago CB Insights wrote an article about it and gathered data in the matrix below:

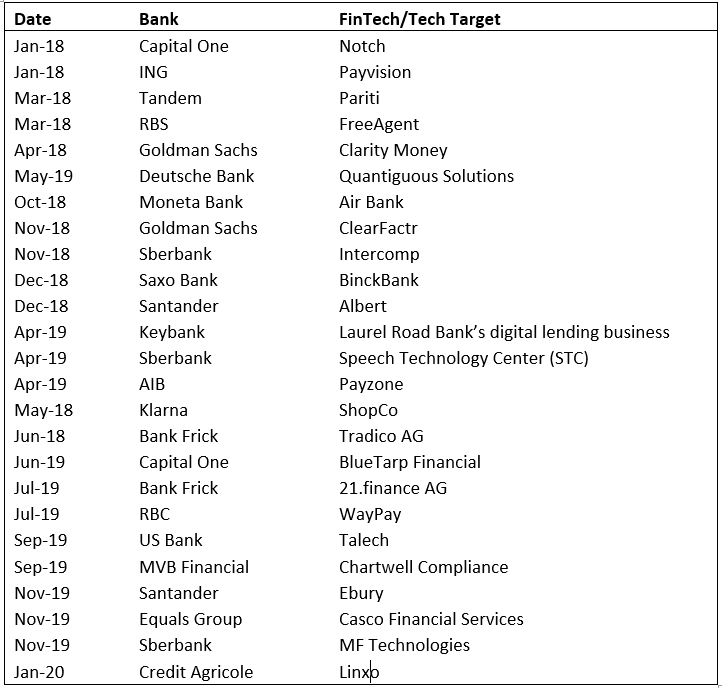

As quite some time has passed since that publication, here is the list of FinTech/Tech acquisitions by large banks for the last two years:

Now compare this to the acquisitions made by Alphabet, Amazon, Apple, Microsoft, and Facebook: To save you the trouble of counting just these five companies made overall 84 acquisitions in the same period, over three times more.

In January this year, Barron’s reported that in 2020 finally banks might be ready to join the FinTech buyout binge and pursue mostly payment companies that have positive profitability.

I do not know what will happen in the future, but I can form an opinion on probabilities and I say the following:

The likelihood of banks becoming active FinTech acquirers at any point in the next couple of years is low, I would say below 30%.

A lot has been written by Forbes, Bloomberg, BankDirector, Tearsheet and others about the rationale of Banking-FinTech M&A and about strategic and cultural reasons why this has not happened yet. While strategy and culture do play a role in explaining banks’ historical behaviour, I would argue that the driving forces behind it are different factors. Banks are simply not fit to be FinTech or any type of technology company acquirers, and there are two primary reasons for it:

Reason 1: Accounting for acquisition goodwill and intangibles hits banks’ capital adequacy very hard

When a company makes an acquisition for the price which exceeds the target’s shareholders’ equity (more accurately book value / market value of net assets, but let’s keep it simple) it records the difference as goodwill. While this is not a problem in many other industries, in banking this is a big deal because that goodwill is deducted from regulatory capital according to current capital adequacy rules.

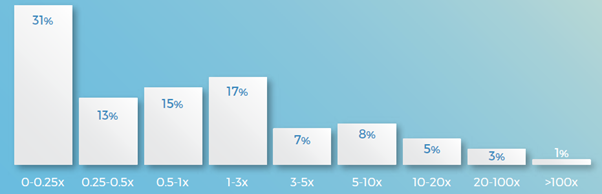

Successful technology startups are frequently acquired for above 3x times multiple of their invested capital. Mind the Bridge and Crunchbase summarised detailed distribution of exit multiples in 2018 Tech Startup M&A Report:

Let’s realistically assume that invested capital at the time of acquisition equals the target’s shareholders’ equity. By buying successful FinTech startup for above 3x times multiple banks must recognize over two-thirds of the price paid as goodwill. Additionally, the majority of tech companies’ assets is composed of software and intangibles. Both, recorded goodwill and software and intangibles will be deducted from the acquirer bank’s regulatory capital.

We can easily illustrate this with a simplified example. if you are familiar with the concept of accounting for goodwill and intangibles in financial institutions you can skip the following paragraph:

Suppose that a bank has $100bn of risk-weighted assets and regulatory capital of $15bn. Capital adequacy ratio would be 15% ($15bn/$100bn), which is a kind of standard today. Now suppose this bank acquired FinTech company Plaid for $5.3bn which by the beginning of 2020 had raised overall $310mn (and was indeed sold to Visa for $5.3bn). As a result of the acquisition, the bank would have to record goodwill of $4,990mn ($5,300mn — $310mn), 94% of the total price paid. additionally, from the remaining $310mn whatever constitutes software would also be deducted from the regulatory capital which would drop from $15bn to approximately $10bn and capital adequacy ratio would plummet to approximately 10%. This means the bank is now undercapitalized. The above might sound illogical as the bank acquired strategically beneficial asset but from a regulatory point of view deteriorated in solvency. Yet this is the reality of current rules.

Considering all this, if banks become active FinTech or any type of tech acquirers they will have to accept bullets in their regulatory capital ratios. Generally, capital adequacy rules for goodwill and intangibles restricts banks from spending money on any business which sells for a high price to book value ratio.

Reason 2: Banks’ CEOs don’t have shareholder mandate and trust to make acquisitions which don’t yield immediate financial benefits and focus on the longer-term strategy

The major driver of M&A activity is the trust executives have with board and shareholders. This is especially true when acquisition rationale is the target’s talent, technology capabilities, and revenue synergies because compared to transactions driven by cost synergies these types of deals are riskier and take longer to create shareholder value due to integration complexities.

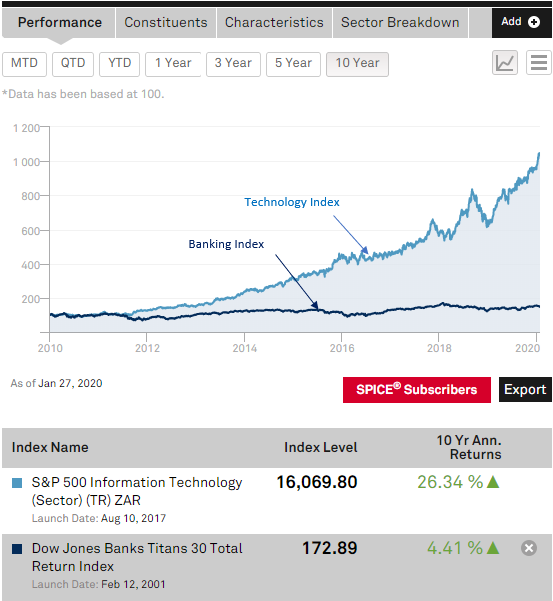

Shareholders’ trust is the main cause of rising M&A activity during times of bullish stock market: When stocks are going high, CEO’s are trusted more and have greenlight for bold moves. The major reason why technology companies can do so many long-term strategic M&A is that they have made shareholders happy over past years and have earned that mandate. You can see in the chart below that technology stocks have delivered 26.3% of annualised returns over the past ten years compared to 4.4% delivered by banks:

It is difficult to get direct data about investors’ attitude towards banking executives, but you can easily design a Minimum Viable Test yourself: just buy 1 share of any publicly traded incumbent bank and attend Annual General Meeting — you will see that life is not easy there.

As a result, bank CEOs do not possess the necessary greenlight from shareholders and they can’t go after FinTech acquisitions which mostly do not yield immediate financial benefits. Today at maximum banks can buy other similar banks for scaling and cost-cutting. Even those acquisitions need to happen at price close to the book value of the target so that large accounting goodwill is not created and does not damage capital adequacy.

What needs to happen for banks to become FinTech acquirers?

At least one or several from below:

- The capital adequacy rules should stop penalising banks for recorded goodwill and intangibles during acquisitions — the probability of this happening is very low.

- Banks must rally in share price performance and earn more trust from shareholders — I am not trying to predict the stock market but today banks are mostly mature value stocks and generating returns vastly above the cost of capital will require quite significant improvements in operations, growth, and profitability.

- Banks must convince their boards and shareholders that the benefits of FinTech acquisitions outsize the capital adequacy hit received — possible, but a tough sell, even if in many cases such acquisitions do make a lot of strategic and business sense and are worth of reducing regulatory capital.

Obviously, there will be some acquisitions and we have seen those happening in the data above, but overall as stated in the beginning I would rate the probability of banks becoming active FinTech acquirers in the coming couple of years as 30% max.

Who will acquire FinTech companies and startups then?

Anyone for whom it provides strategic benefits and who does not have the above-mentioned restrictions. For example, companies from payments, big tech, financial software and other FinTech spaces. We are seeing this happening, but a detailed exploration of this topic is another large theme outside of the scope of this post.

What does this mean for banks?

As acquiring technology and innovation from outside is less viable option, banks need to upgrade organically, change the culture and improve operations in order to stay long-term competitive in the current fast-changing environment of financial services. Today this is as important as never before. To their credit, banks have put a lot of effort into this over past 4–5 years and we will see what the results will be in the next half-decade.

What does this mean for FinTech startups?

Compared to other technology startups FinTechs have a smaller chance to be acquired because their “natural” acquirer banks are quite handcuffed. As venture capital investors want liquidity in approximately 5–7 years, public markets will have to account for a larger proportion of FinTech exits than they do in “OtherTech” spaces. M&A will still be the most common exit option in FinTech, but with a smaller proportion.

The single most important thing which matters for a successful IPO is the clear path to the stable and profitable growth of the company at the time of going public, to fit the risk-return appetite of investors. This means that FinTech startups need to pay attention to stabilizing and normalizing the growth of positive unit economics earlier and start preparing for IPO timelier than their peers from other technology spaces.

What does this mean for FinTech investors?

The valuation of any company in public markets reflects the probability of being acquired. And it is ultimately public markets which step by step influence and transcend their valuation levels down to private markets, even to the seed and angel stages.

At any funding stage, investors must account for the fact that banks are less likely members of potential buyers’ universe for FinTech startups and the resulting shrinking exit opportunity should be incorporated in the valuation, especially during benchmarking against comparable companies from other technology spaces whose potential buyers’ list is larger and more active.

In conclusion

We all just can’t wait for the final season of our favourite TV show when after so many years of flirting and drama the two protagonists unite and live happily ever after. In the case of Banking-FinTech complicated love-hate relationship, this is not likely to happen in the coming years. But while the show goes on, we can analyse the reasons behind the current scenario and act prudently on it.

Acknowledgements: I would like to thank and acknowledge professionals from the industry who helped gather data and discuss insights in this post: FinTech entrepreneur David Melikidze, FinTech executive Volodymyr Vasyuta, innovation strategy professionals Ana Sofia Almagro and Mathilde Carraro.